San Francisco Municipal Transit Authority (SFMTA) spokesperson, Paul Rose, acknowledged to the press that there is a dearth of taxi medallions being issued to cab drivers in San Francisco, according to the California Watch. While names of drivers languish on the waiting list, San Franciscans and visitors alike complain about the price and unavailability of taxis around the city. Standing on the corner of a busy intersection is no guarantee that an open cab will pass you by, but calling a cab company for pick up can be just as frustrating. The long wait times and lack of communication leave customers fed up, and they just may have left already by the time the taxi finally arrives.

San Francisco Municipal Transit Authority (SFMTA) spokesperson, Paul Rose, acknowledged to the press that there is a dearth of taxi medallions being issued to cab drivers in San Francisco, according to the California Watch. While names of drivers languish on the waiting list, San Franciscans and visitors alike complain about the price and unavailability of taxis around the city. Standing on the corner of a busy intersection is no guarantee that an open cab will pass you by, but calling a cab company for pick up can be just as frustrating. The long wait times and lack of communication leave customers fed up, and they just may have left already by the time the taxi finally arrives.

According to the SFMTA website, it has sent out only 12 offer letters to purchase a medallion in all of 2012 to drivers on the waiting list. It had, however, issued 142 single operator permits as of May 2012. While the city drags its feet, entrepreneurs have been streamlining the idea of carpooling with a cash incentive for drivers. Companies like Lyft and Sidecar have entered the San Francisco market in recent years. Drivers may sign up with one of the services if they have a clean driving record, pass a criminal background check, and who have a valid driver’s license, proof of registration and insurance, among other basic requirements. Pedestrians looking for a ride use a mobile app to determine which car is closest to them, then they send out a ride request. Payment takes the form of a “donation”, meaning the passenger pays what they think is fair. Patrons often pay less than they would for a cab, the driver keeps the “donation”, and Lyft or Sidecar, takes 20% off the top. Sidecar also allows passengers and drivers to rate each other on its mobile app.

In an interview with Time, the co-founder of Lyft, John Zimmer, responded to questions about the potential for push back from San Francisco taxis rather optimistically saying, “We haven’t heard from them…I think they’re watching very closely to see if they can learn something.” Instead, taxi owners have complained that these services are running illegal taxi companies. They bristle when comparing costs for themselves and for the ride share drivers. Taxi drivers must maintain million dollar insurance policy, they must purchase a taxi medallion, and they must pay the other costs of a highly regulated industry. Meanwhile, the ride share drivers are required to have the minimum insurance required in California for personal policies, as the companies maintain they are a matching service and not a transportation carrier.

The SFMTA has not decided what to do about the up and coming pay per ride carpooling industry. It remains to be seen whether a basic car insurance policy is sufficient to cover damages in the event of an accident involving a passenger who signed up for a ride with one of the carpooling services. Once damages go beyond the insurance policy’s limits, will the service provider be liable as well? According to Lyft’s Terms of Agreement, “Such Driver will be solely responsible for any and all liability which results from or is alleged as a result of the operation of the vehicle such Driver uses to transport Riders, including, but not limited to personal injuries, death and property damages.” Sidecar’s Terms of Agreement also denies the company has any responsibility for damages associated with a ride matched through its service. In the future, the city of San Francisco or other governmental entities could have the last say.

Continue Reading ›

San Francisco Injury Lawyer Blog

San Francisco Injury Lawyer Blog

San Francisco Municipal Transit Authority (SFMTA) spokesperson, Paul Rose, acknowledged to the press that there is a dearth of taxi medallions being issued to cab drivers in San Francisco, according to the

San Francisco Municipal Transit Authority (SFMTA) spokesperson, Paul Rose, acknowledged to the press that there is a dearth of taxi medallions being issued to cab drivers in San Francisco, according to the  We pay for insurance not only because it is often a legal obligation but also because we want the coverage to be there when we need it. As your

We pay for insurance not only because it is often a legal obligation but also because we want the coverage to be there when we need it. As your  While lead poisoning can impact nearly every system in the human body, it often has few or no obvious early symptoms. High levels of lead can damage kidneys, cause high blood pressure and other forms of heart disease, cause gastrointestinal and neuromuscular problems, and impact both male and female reproductive systems. Lead can pass from a mother to a baby while in utero, leading to a risk of miscarriage, premature birth, and developmental problems in childhood. Lead is particularly dangerous to the nervous system and while damage to some systems may be reversible if treated, damage to the central nervous system cannot be reversed. Children’s nervous systems are especially at risk with lead exposure causing decreased brain volume and other neural damage that may lead to learning and developmental disabilities. Memory, reasoning skills, reading ability, attention span, and social skills can be harmed at very low blood levels, particularly in the fast-developing brains of younger children. Lead exposure can also shorten life span and lead to increased death rates from a number of related causes.

While lead poisoning can impact nearly every system in the human body, it often has few or no obvious early symptoms. High levels of lead can damage kidneys, cause high blood pressure and other forms of heart disease, cause gastrointestinal and neuromuscular problems, and impact both male and female reproductive systems. Lead can pass from a mother to a baby while in utero, leading to a risk of miscarriage, premature birth, and developmental problems in childhood. Lead is particularly dangerous to the nervous system and while damage to some systems may be reversible if treated, damage to the central nervous system cannot be reversed. Children’s nervous systems are especially at risk with lead exposure causing decreased brain volume and other neural damage that may lead to learning and developmental disabilities. Memory, reasoning skills, reading ability, attention span, and social skills can be harmed at very low blood levels, particularly in the fast-developing brains of younger children. Lead exposure can also shorten life span and lead to increased death rates from a number of related causes. Take something as simple as a car accident. Many assume that the accident was one party’s fault and that the person at fault can be sued for the harm caused. While that is true, there may be many other parties who also contributed to the accident. For one thing, both drivers may share responsibility. In addition, there may have been a problem with the car itself which means that manufacturer could face liability. Perhaps the street or safety barriers were not properly maintained, implicating the government agency responsible for the accident. Maybe there was debris in the road left negligently by another car which was not even in the incident. Mechanics, pedestrians, and many other parties could also have contributed–in full or in part–to the ultimate incident. The point is that many accidents are far more complex than they first seem. A

Take something as simple as a car accident. Many assume that the accident was one party’s fault and that the person at fault can be sued for the harm caused. While that is true, there may be many other parties who also contributed to the accident. For one thing, both drivers may share responsibility. In addition, there may have been a problem with the car itself which means that manufacturer could face liability. Perhaps the street or safety barriers were not properly maintained, implicating the government agency responsible for the accident. Maybe there was debris in the road left negligently by another car which was not even in the incident. Mechanics, pedestrians, and many other parties could also have contributed–in full or in part–to the ultimate incident. The point is that many accidents are far more complex than they first seem. A

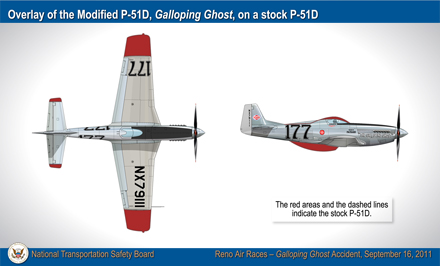

The National Transportation Safety Board (NTSB) announced on August 21, 2012 that it has opened to the public its docket relating to a September, 2011 incident in which the “Galloping Ghost” aircraft

The National Transportation Safety Board (NTSB) announced on August 21, 2012 that it has opened to the public its docket relating to a September, 2011 incident in which the “Galloping Ghost” aircraft  A bill pending before California lawmakers caught the attention of our

A bill pending before California lawmakers caught the attention of our